Introduction to the BRRRR Method

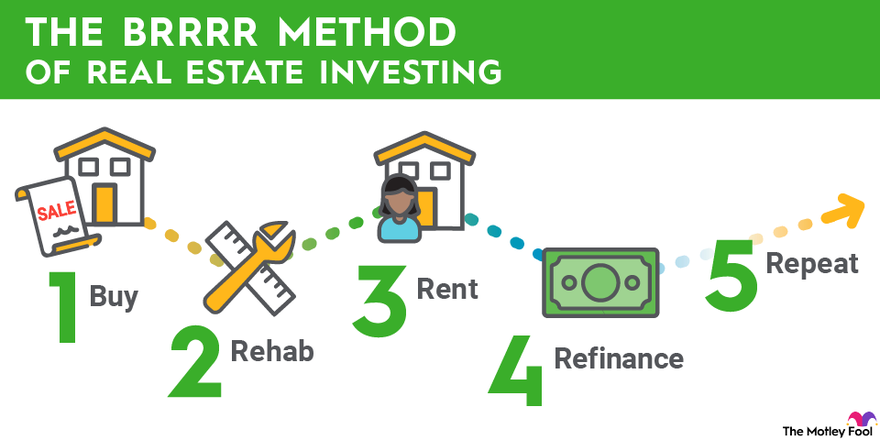

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat, is a comprehensive real estate investment strategy that has gained considerable traction among investors in recent years. This approach enables investors to build wealth through real estate in a systematic and potentially lucrative manner. The BRRRR method focuses on purchasing undervalued properties, initiating renovations to elevate their market value, and then converting them into rental units, thus allowing for both immediate and long-term financial benefits.

The underlying principle of the BRRRR method is centered on creating equity through strategic improvements. Investors buy properties at a lower price point, allowing them to leverage the difference between the purchase price and the increased value resulting from renovations. This equity not only serves as a valuable asset but also provides opportunities for refinancing. The refinance phase is crucial, as it allows investors to extract a portion of their equity, which can then be reinvested into additional properties. This cyclical process of reinvestment is where the ‘Repeat’ component of the method comes into play.

The growing popularity of the BRRRR method can be attributed to its structured framework, enabling both novice and seasoned investors to navigate the complexities of real estate investing effectively. It empowers individuals to control their cash flow, mitigate risks, and potentially achieve financial independence through real estate. With rising housing prices and increasing demand for rental properties, this investment strategy presents a viable pathway for wealth accumulation.

In summary, the BRRRR method is more than just an investment technique; it represents a shift in how individuals can approach real estate as a means to achieve financial success. By understanding and applying this method, investors can unlock the potential within the real estate market while concurrently fostering sustainable growth in their portfolios.

Buying Your First Property

The initial phase of the BRRRR method—Buy, Rehab, Rent, Refinance, and Repeat—is undoubtedly critical, as it sets the foundation for successful investment in real estate. Therefore, thorough market research is essential in identifying the right property. This research involves evaluating neighborhood trends, rental statistics, and overall market conditions to ensure a wise investment decision. Understanding the economic factors that influence property values can significantly enhance the likelihood of maximizing returns.

Once the market research is completed, the next step is identifying potential properties that align with investment goals. Investors should focus on properties that require some level of rehabilitation, as these often present significant opportunities for value appreciation. The criteria for a suitable property should include not only its current condition but also its location and the potential for rental demand in the area. A promising property typically falls into a category where minor or major renovations can lead to increased rental income and overall value.

When analyzing deals, it’s crucial to perform a detailed cost-benefit analysis. Calculate all acquisition costs, including purchase price, closing costs, and estimated renovation expenses. This analysis allows investors to determine the viability of the investment and ensure that it meets their financial goals. Financing options play a critical role in the purchasing process, and understanding the various lending avenues—conventional loans, hard money loans, or partnerships—can influence decision-making. Acquiring a property through strategic financing can optimize cash flow and preserve capital for future investments.

Choosing the right property, diligent market research, a thorough deal analysis, and knowledgeable financing options constitute the cornerstone of a successful first purchase in the BRRRR method. By focusing on properties with value-add potential, investors position themselves to achieve substantial returns and lay the groundwork for future expansion in their real estate portfolio.

Rehabilitation: Adding Value to Your Investment

The rehabilitation phase is a crucial component of the BRRRR method, acting as a linchpin in transforming a property, both physically and financially. During this stage, investors focus on renovation efforts aimed at increasing the property’s value and establishing a sustainable rental income stream. Effective rehabilitation involves careful planning, budgeting, and execution, ensuring that investments yield the highest possible return.

To begin, it is essential to develop a comprehensive budget for repairs and enhancements. Investors should conduct thorough inspections to identify critical areas requiring attention. This may include foundational repairs, plumbing updates, electrical system overhauls, or cosmetic improvements such as painting and flooring. Keeping a contingency fund—typically around 10% to 20% of the overall budget—can help navigate unforeseen expenses that may arise during the rehabilitation process.

Simultaneously, selecting the right contractors is pivotal to the success of the rehabilitation. Engaging professionals with proven experience in similar projects can ensure high-quality workmanship and adherence to timelines. It is advisable to obtain multiple quotes from different contractors, allowing for comparison not just of costs, but also of the scope of work and timelines. Conducting background checks and asking for references can further solidify the choice of contractor, minimizing future complications during the renovation.

Strategic improvements that maximize return on investment should also be prioritized. For instance, kitchens and bathrooms typically yield the highest return; thus, updates in these areas can significantly enhance property appeal. Moreover, addressing curb appeal—such as landscaping and exterior paint—can attract prospective tenants and command higher rental rates. However, common pitfalls often include over-improving beyond the neighborhood standards or neglecting essential repairs in favor of cosmetic enhancements. It is crucial to maintain a balanced focus on both aesthetics and functionality throughout the rehabilitation process.

Renting Out the Property

Once a property has undergone rehabilitation through the BRRRR method, the subsequent step involves effectively renting it out to secure a steady stream of income. This phase is crucial because the quality of tenants significantly influences the long-term success of an investment. Engaging in comprehensive tenant screening is paramount to identify responsible renters who can meet their financial obligations consistently. A thorough evaluation typically includes credit checks, rental history verification, and income assessments, ensuring that only qualified tenants are selected.

The setting of appropriate rental rates is another pivotal consideration. It is essential to conduct a comparative market analysis to determine a competitive yet profitable pricing structure. This step not only maximizes income potential but also reduces the risk of prolonged vacancies. Once the rental price is established, marketing the property effectively comes into play. Utilizing online platforms, social media, and traditional marketing methods can attract a broader audience. High-quality photographs and detailed property descriptions highlighting the rehab improvements will create a compelling listing.

Moreover, drafting a comprehensive leasing agreement is vital to protect both the landlord and the tenant. This document should encompass essential terms, including the rental amount, payment deadlines, maintenance responsibilities, and any pet policies. Clarity in these agreements helps to mitigate potential disputes in the future.

In terms of property management, investors have several options from self-management to hiring a professional property management company. While self-management may provide more control over the rental process and save costs, professional management offers expertise and efficiency in handling tenant relations and property maintenance. Whichever route one chooses, effective tenant communication and responsiveness to their needs will foster a positive relationship, ultimately leading to longer tenancy durations and increased investment returns.

Refinancing: Unlocking Your Investments

Refinancing is a critical component of the BRRRR method, as it allows real estate investors to leverage the equity accrued through property rehabilitation to finance additional acquisitions. By tapping into this equity, investors can effectively recycle their initial cash outlay, creating a virtuous cycle of real estate investing. To begin the refinancing process, investors should first assess the value of the property post-renovation, as this will directly influence the amount of equity available.

There are generally two types of refinancing options to consider: rate-and-term refinancing and cash-out refinancing. Rate-and-term refinancing enables investors to lower their interest rates or alter the term of their loan while leaving the original equity intact. On the other hand, cash-out refinancing allows borrowers to access the equity built through renovations, providing them with additional capital to reinvest in further properties. Each option carries its own set of guidelines and implications, necessitating careful evaluation to align with your investment goals.

Lenders typically evaluate several key metrics when considering a refinancing application. These factors include the Loan-to-Value (LTV) ratio, debt-to-income (DTI) ratio, and credit score, which significantly impact the interest rates and terms offered. It is essential to prepare a well-structured presentation of your investment portfolio, including detailed documentation of the property’s cash flow and comparative market analyses, to increase the likelihood of favorable refinancing terms.

Timing also plays a pivotal role in refinancing success. Engaging in the process during periods of low interest rates or favorable market conditions can greatly enhance profitability. The investors should monitor the market trends continually, ensuring they capitalize on special refinancing opportunities. By strategically integrating refinancing into their overall investment strategy, investors can not only enhance their returns but also build a more robust property portfolio.

The Repeat Strategy: Scaling Your Portfolio

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat, provides a robust framework for real estate investors looking to scale their portfolios. The crucial component of this strategy lies in its repeat aspect. Once an investor has successfully completed the initial BRRRR cycle, they can leverage the increased equity from refinancing to purchase additional properties, allowing for significant portfolio expansion over time. This ability to capitalize on equity can transform a single investment into a diverse portfolio of rental properties.

To effectively manage multiple properties, investors should develop a solid organization system and maintain clear records for each investment. Utilizing software tools for property management can enhance efficiency and help keep track of rental income, expenses, maintenance schedules, and tenant communications. Understanding the nuances of property management is essential as it can often be a significant commitment, particularly when scaling up operations.

Moreover, investors must remain vigilant about potential pitfalls that can accompany rapid growth. These may include cash flow challenges or maintenance issues that arise from owning multiple properties. It’s critical for investors to ensure that their cash reserves are sufficient to handle unexpected costs and that they are prepared for the time commitment required to manage properties effectively. Additionally, seeking expertise from seasoned real estate professionals can provide insights into best practices for managing a growing portfolio and avoiding common mistakes.

Success stories abound in the real estate community, showcasing individuals who have skillfully navigated the repeat strategy of BRRRR. By applying disciplined financial strategies and diligent management of their properties, many investors have successfully scaled their portfolios to include multiple units, significantly enhancing their wealth and passive income sources. The key to success lies in diligent planning, continuous education, and the ability to adapt as the portfolio grows.

Common Challenges and How to Overcome Them

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat, is a popular strategy for real estate investors. However, like any investment strategy, it comes with its own set of challenges. Understanding these hurdles and having practical solutions can significantly improve the execution of the BRRRR strategy.

One common challenge investors face is financing issues. Securing funding for both the property purchase and the extensive renovations can be daunting. The key to overcoming this obstacle is to conduct thorough research on financing options, such as traditional mortgages, hard money loans, or private investors. Establishing a solid relationship with a financial institution or a lender who understands the BRRRR strategy can also smooth the process. Additionally, preparing a comprehensive business plan showcasing the property’s potential can be instrumental in securing the necessary capital.

Another significant challenge is unexpected renovation costs. The unpredictability of renovation can often lead to budget overruns, which can impact the overall profitability of the investment. To mitigate this challenge, it is advisable to include a 10-15% contingency in the renovation budget. Hiring experienced contractors and conducting a detailed property inspection prior to purchasing can help uncover potential issues early, allowing for informed budgeting. Furthermore, being prepared with alternative financing options for unexpected expenses can ensure that the project stays on track.

Finally, tenant management presents its own set of challenges. Finding reliable tenants can be difficult, and dealing with vacancies or tenant issues may elevate stress levels for investors. A solution is to employ a property management company that specializes in the local market. This not only reduces the burden of tenant management but also enhances the likelihood of finding qualified tenants. Creating a clear tenant screening process with defined criteria can aid in attracting responsible occupants.

Pros and Cons of the BRRRR Method

The BRRRR method, an acronym for Buy, Rehab, Rent, Refinance, and Repeat, is a real estate investment strategy that has gained popularity due to its potential for wealth accumulation and passive income generation. However, like any investment technique, it encompasses both advantages and disadvantages that investors should carefully consider.

One of the primary advantages of the BRRRR method is its ability to build significant wealth over time. By acquiring undervalued properties, making strategic improvements through rehabilitation, and subsequently renting them out, investors can create a reliable income stream. This not only provides immediate cash flow but also enhances property value, allowing for greater returns during the refinance phase. With proper execution, investors can reinvest the equity gained from refinanced properties, facilitating the acquisition of additional real estate assets.

Moreover, the BRRRR strategy allows for the creation of passive income streams, effectively benefiting individuals seeking financial security. Once properties are rented out, they can continue generating earnings with relatively minimal involvement, provided that property management systems are in place. This characteristic makes the strategy appealing to those aiming for long-term financial independence.

On the other hand, the BRRRR method entails considerable time commitment and financial risk. The process of successfully rehabilitating properties demands not only time but also expertise in property management and renovations. Additionally, market fluctuations can affect rental demand and property values, leading to potential financial losses for investors who are unprepared for such variables. Furthermore, financing the purchase and renovation entails significant out-of-pocket costs, posing a risk if the property does not yield the anticipated returns.

In conclusion, while the BRRRR method can offer substantial rewards in real estate investing, investors must be diligent in assessing their capacity to engage with its complexities and the inherent risks associated with the approach.

Real-Life Case Studies

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat, has attracted a considerable number of investors looking to build wealth through real estate. By examining various case studies, aspiring investors can gain valuable insights into the application of this strategy in diverse markets.

One notable case is that of an investor who focused on single-family homes in a suburban area. Initially, this investor purchased a distressed property at a significant discount. By allocating a portion of their budget to essential renovations, such as updating kitchens and bathrooms, they were able to increase the property’s value substantially. Once the home was rented, the investor proceeded to refinance, pulling out equity that was then used to purchase another distressed property. This cycle of buying, rehabilitating, and leveraging equity persisted, ultimately expanding their portfolio significantly in just a few years.

Another compelling example comes from an investor specializing in multi-family units in an urban setting. This investor adopted a slightly different approach. After acquiring a duplex in a high-demand area, they focused on making both cosmetic and functional improvements, such as modernizing the units and enhancing curb appeal. By increasing the rent commanded from each unit, they were able to refinance shortly after the renovations, effectively using the cash-out to fund additional multi-family purchases. This investor’s strategy not only capitalized on rising rental demand but also benefited from greater efficiency in managing multiple units simultaneously.

These case studies illustrate that while the BRRRR method is systematic, individual outcomes can vary based on location, property type, and investor adaptability. It emphasizes the importance of thorough market research and strategic planning, allowing future investors to learn valuable lessons and gain practical insights from those who have successfully navigated the BRRRR landscape.

Conclusion and Next Steps

The BRRRR method—Buy, Rehab, Rent, Refinance, Repeat—represents a compelling strategy in the realm of real estate investing. It allows investors to maximize their cash flow while building equity over time. Throughout this guide, we have explored the key components of the BRRRR method, shedding light on how each step contributes to creating a sustainable investment portfolio. By making strategic purchases, increasing property value through renovations, and effectively managing rental agreements, investors can create a self-sustaining cycle of growth within their real estate ventures.

As one considers embarking on a journey utilizing the BRRRR strategy, it is essential to take actionable steps towards effectively implementing this method. First and foremost, investing time in setting up a comprehensive plan is crucial. This plan should outline investment goals, budget considerations, and timelines, serving as the foundation for future success. Next, building a reliable team composed of real estate agents, contractors, property managers, and financial advisors will greatly enhance the efficacy of the BRRRR approach. Each team member brings valuable insights and expertise that can streamline processes and minimize risks associated with property investment.

Furthermore, continuous education in real estate investing is paramount. The dynamic nature of this field necessitates a commitment to staying informed about market trends, financial strategies, and legal regulations. Engaging in workshops, reading industry publications, or participating in real estate investment groups can provide valuable knowledge and networking opportunities that enrich one’s investment journey. By remaining committed to learning and adapting, investors can maximize the benefits of the BRRRR method and navigate potential challenges effectively.

In conclusion, the BRRRR method offers a proven pathway for real estate investors aiming to build wealth sustainably. With careful planning, a cohesive team, and a dedication to ongoing education, individuals can harness the power of this strategy and achieve their investment goals.