Introduction to Multiple Income Streams

In contemporary financial discussions, the term “multiple income streams” refers to the practice of generating income from more than one source. This concept has gained prominence due to the unpredictability of traditional employment and the increasing cost of living. As individuals seek greater financial stability and security, diversifying income sources has become not just advantageous but essential. Multiple income streams encompass various forms of revenue, including part-time jobs, freelance work, investments, rental income, and residual income from product sales or affiliate marketing.

The pursuit of multiple income streams is fundamentally rooted in the principle of diversification. This principle, widely applicable in investment strategies, suggests that by having various sources of income, individuals can mitigate the risks associated with relying solely on a single source. For example, losing a primary job can have devastating financial consequences, but having additional income streams can provide a crucial safety net that allows individuals to maintain their standard of living during career transitions.

Furthermore, the ability to generate multiple income streams offers individuals the opportunity to pursue their passions and interests. With advancements in technology and the rise of the gig economy, it has become easier than ever to explore various avenues of income generation. From online businesses to content creation, there are countless opportunities to augment existing earnings while fostering personal fulfillment.

In essence, adopting multiple income streams is a proactive approach to achieving financial independence and enhancing one’s quality of life. The current economic climate underscores the importance of this strategy, as individuals and families aim for not only surviving but thriving amidst uncertainties. This blog post will delve deeper into the methods and benefits of cultivating multiple income streams that can empower individuals to lead extraordinary lives.

Understanding Ordinary vs. Extraordinary Lives

The distinction between ordinary and extraordinary lives often lies in mindset, resourcefulness, and financial management. Ordinary lives may encompass routines and conformities, driven predominantly by traditional employment, where an individual relies on a single source of income. In contrast, extraordinary lives reflect a proactive approach, where individuals embrace multiple income streams to secure financial stability and flexibility. This diversification is not merely a financial strategy; it embodies a philosophy that fosters personal growth and resilience.

Individuals leading extraordinary lives tend to possess a characteristic entrepreneurial spirit, indicating their willingness to pursue non-traditional avenues for income generation. They often seek opportunities beyond a nine-to-five job, tapping into creative endeavors, passive income ventures, or investments that augment their financial well-being. This strategic approach helps them build wealth, providing a safety net that enables them to take calculated risks and pursue passions that may not yield immediate financial rewards.

The mindset required to achieve an extraordinary life is also vital to this distinction. It entails a belief in continuous learning and adaptability, allowing individuals to navigate the complexities of financial landscapes effectively. By embracing a growth-oriented outlook, those seeking extraordinary lives view challenges as opportunities for improvement, learning from setbacks rather than being deterred by them. This resilience is often supported further by an understanding that financial independence allows for greater freedom, leading to a more fulfilling and balanced lifestyle.

Ultimately, the choice between living an ordinary or extraordinary life boils down to mindset, the willingness to diversify income sources, and an unwavering commitment to personal development. By understanding these distinctions, individuals can set themselves on a path toward extraordinary living, unlocking the potential for greater financial security and fulfillment.

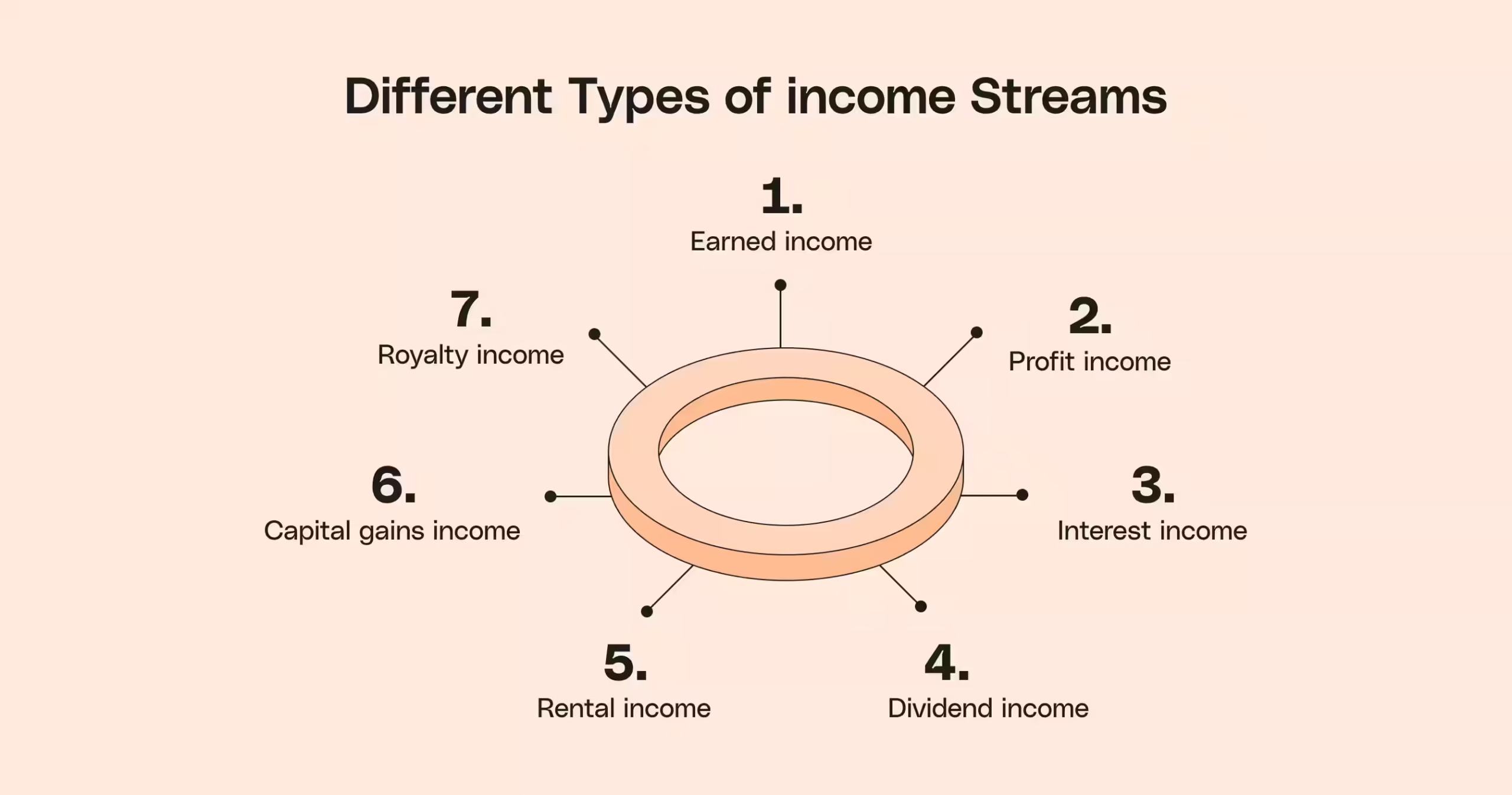

Identifying Potential Income Streams

In today’s dynamic financial landscape, individuals have the opportunity to explore multiple income streams, which can serve as a hedge against economic fluctuations and provide financial stability. To start, it is vital to distinguish between active and passive income sources. Active income typically entails exchanging time and effort for compensation, as seen in traditional employment or side gigs. For instance, freelance writing, tutoring, or consulting are excellent ways to utilize specific skills while generating additional income. These activities not only enhance financial security but can also cultivate professional growth.

On the other hand, passive income refers to earnings derived from investments or businesses where active participation is minimal. Examples include dividend stocks, peer-to-peer lending, and rental properties. Individuals seeking passive income opportunities should consider their risk tolerance, investment expertise, and the initial capital needed for entry. Real estate investments, particularly rental properties, can yield significant returns, provided that thorough market research is conducted to identify lucrative locations and property types.

The advent of technology has further broadened the landscape for online businesses, where individuals can create income streams through e-commerce, affiliate marketing, or content creation. Platforms like Shopify, Amazon, and various social media channels allow entrepreneurs to reach global markets efficiently. When evaluating these online opportunities, it is essential to align them with personal interests and capabilities to maintain motivation and engagement in the long term.

Ultimately, choosing the right income streams requires a comprehensive assessment of one’s skills, interests, and available resources. By systematically exploring different options, individuals can build a diversified income portfolio that caters to both immediate financial needs and long-term aspirations. Starting with small, manageable ventures can lead to significant growth, increasing both confidence and expertise in navigating the multiple income streams landscape.

Benefits of Multiple Income Streams

In today’s rapidly changing economy, the advantages of maintaining multiple income streams have become increasingly evident. One of the primary benefits is enhanced financial security. Relying solely on a single job can pose significant risks; job loss, economic downturns, or unexpected health issues can severely jeopardize one’s financial stability. By diversifying income sources—whether through part-time jobs, freelance work, rental properties, or investments—individuals can mitigate these risks and ensure a more stable financial foundation.

Another notable benefit of multiple income streams is the potential for increased savings. With supplementary income, individuals can allocate additional funds towards savings and investment opportunities, which can significantly impact their long-term financial health. This increased capacity to save allows for greater flexibility in making life choices, including purchasing a home, funding education, or planning for retirement. Such financial preparedness enhances not only individual security but also supports a stress-free emotional well-being.

The freedom of choice is another compelling advantage of multiple income streams. By diversifying income sources, individuals may find themselves less bound to a single employer, allowing them greater control over their career paths. This autonomy encourages individuals to pursue work that aligns better with their passions or interests, enhancing both job satisfaction and personal fulfillment. Additionally, when people are not solely beholden to one job, they can explore entrepreneurial ventures or passion projects that may lead to opportunities for professional growth or financial reward.

Moreover, having multiple income streams fosters a sense of resilience. Individuals with diversified income sources can adapt more easily to changes and challenges that arise in different economic environments. As a result, not only does this diversification lead to financial prospering, but it also inspires a mindset geared towards growth and adaptability. Each of these benefits contributes to an overall enhancement in quality of life and personal fulfillment.

Creating a Plan to Establish Income Streams

Establishing multiple income streams is a strategic approach to enhancing financial stability and increasing wealth. A well-structured plan begins with assessing the current financial situation. Begin by reviewing all sources of income, including salaries, investments, and any side businesses. It is essential to understand both income and expenses to determine how much capital can be allocated toward new ventures. This assessment will serve as a foundation for identifying opportunities for additional income streams.

Once the financial assessment is complete, the next step involves setting realistic goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, aspiring to generate an additional 20% of current income within the next year can provide a clear target. Establishing timelines for achieving these milestones can facilitate progress tracking. It is crucial to remain flexible, as goals may need to be adjusted based on personal circumstances or market conditions.

Identifying potential income sources is the subsequent phase. This could involve exploring side jobs such as freelancing, investing in real estate, or starting an online business. Engaging in thorough research into various options is vital, as each has its own level of risk and required commitment. Networking with individuals who have successfully created multiple income streams can provide valuable insights and inspire new ideas.

Lastly, maintaining a balanced approach is critical in this journey. Striking a balance between time, effort, and financial investment across different income sources will help ensure sustainability. Prioritizing self-care and establishing boundaries can prevent burnout. By systematically implementing these strategies, individuals can create a robust plan for not only establishing multiple income streams but also securing a more financially resilient future.

Overcoming Challenges in Building Income Streams

Establishing multiple income streams is an admirable goal, yet it comes with its own set of challenges. One prominent obstacle is time management. Individuals often struggle to balance their primary responsibilities with the demands of side projects or investments. Effective time management strategies can be instrumental in overcoming this hurdle. Utilizing tools such as digital calendars or productivity apps can help streamline tasks, ensuring that time is allocated efficiently across various income-generating endeavors.

Financial risk is another significant concern when venturing into multiple income streams. Whether it involves investments in stocks, real estate, or starting a small business, the potential for loss exists. It is crucial to conduct thorough research and due diligence before committing capital to any venture. Embracing a calculated risk approach can lead to informed decision-making. This may involve starting small, diversifying investments, and regularly reassessing financial stands to mitigate potential losses.

Maintaining motivation is equally essential yet often proves challenging. The journey towards establishing multiple income streams can be long and fraught with setbacks. Setting clear, achievable goals is key in maintaining focus. Breaking down larger objectives into smaller, manageable tasks can facilitate progress and enhance motivation. Regularly celebrating small successes can help in cultivating a positive mindset, further encouraging persistence despite difficulties.

Ultimately, while challenges exist in building multiple income streams, they are not insurmountable. By adopting effective time management techniques, mitigating financial risks through careful planning, and sustaining motivation through goal-setting, individuals can transform potential obstacles into avenues for growth and success. This proactive approach not only builds resilience but also enhances the overall journey towards achieving financial independence and stability.

Real-Life Success Stories

Many individuals have embraced the concept of multiple income streams, transforming their financial situations and paving the way for more extraordinary lives. One notable example is Sarah, a marketing professional who leveraged her expertise by creating a side business as a freelance consultant. Initially starting with just a few clients, her dedication and strategic networking multiplied her income, allowing her to decrease her reliance on her primary job. Over time, Sarah has built a robust consultancy that not only provides her with financial security but also the freedom to diversify her career.

Another inspiring story is that of Mark, a teacher who sought additional ways to earn income to provide for his family. In addition to his teaching job, he began creating online tutorials focusing on his subject matter. By utilizing platforms such as YouTube and educational websites, Mark was able to generate a steady stream of revenue from ad placements and course subscriptions. His efforts enabled him to fund his children’s education and save for future investments, thereby constructing a diversified income portfolio that secured his family’s financial future.

Similarly, Emily, a stay-at-home parent, discovered various online business opportunities that leveraged her hobbies and skills. By starting a blog and an associated e-commerce site, she shared crafting ideas and homemade goods. Her ability to connect with a niche audience led to multiple sales channels, including affiliate marketing and product sales. As her online presence grew, so did her income. This venture not only enriched her life financially but also provided her a creative outlet and a sense of purpose.

These success stories illustrate that creating multiple income streams is not just a theoretical concept but a viable path to achieving greater financial freedom. Each individual’s journey showcases the diverse avenues available for income generation, inspiring readers to explore their potential and take actionable steps towards financial diversification.

Long-Term Strategies for Sustaining Income Streams

Managing multiple income streams requires a strategic approach to ensure sustainability and growth over time. One essential aspect is the ability to adapt to market changes. The economic landscape is dynamic, and fluctuations in consumer behavior, technological advancements, and regulatory changes can significantly impact income-generating activities. Regularly assessing market trends and consumer demands enables individuals to pivot their strategies effectively, minimizing potential losses and maximizing profit potential.

Another important strategy is to reinvest earnings from one income stream into others. This creates a compounding effect that can significantly enhance overall income. For instance, if you have a profitable side business or investment, utilizing a portion of those earnings to expand into new ventures, such as real estate or stocks, can provide an additional layer of financial security. It encourages diversification and mitigates risks that often accompany relying on a single income source.

Education plays a pivotal role in the long-term success of multiple income streams. Continuously seeking knowledge through courses, workshops, and reading can equip income stream participants with the tools necessary to enhance their current strategies and explore new opportunities. Staying informed about financial literacy, investment strategies, and market trends empowers individuals to make sound decisions that contribute to the longevity and growth of their income streams.

Moreover, networking with like-minded individuals, attending industry gatherings, or joining online forums can enhance your understanding of emerging trends and best practices. Engaging with a community provides not only support but can also lead to collaborative opportunities. By nurturing relationships with innovative thinkers, individuals can enhance their business strategies and discover new avenues for generating income.

Implementing these long-term strategies is crucial for anyone seeking to develop and sustain multiple income streams effectively. With the right approaches, individuals can turn their multiple income streams into enduring sources of financial freedom.

Conclusion: Embracing the Extraordinary

In today’s dynamic economic landscape, the concept of multiple income streams has emerged as a vital strategy for individuals seeking both financial security and a more fulfilling life. The discussions throughout this article have highlighted how diversifying one’s income can significantly enhance one’s financial stability while also providing opportunities for personal growth and enrichment. Embracing multiple income streams not only acts as a safeguard during unforeseen economic downturns but also paves the way for exploration and innovation in various fields.

The journey toward creating diverse income sources begins with an awareness of one’s skills and passions. By identifying areas of expertise, individuals can pursue different avenues, whether through freelancing, investing, or starting a side business. Each income stream adds a layer of resilience, allowing individuals to adapt to changes in the job market or personal circumstances. Moreover, this diversification enables individuals to engage in projects that excite them, ultimately resulting in a more satisfying and balanced lifestyle.

Furthermore, the ability to harness the power of technology has made it easier than ever to explore these opportunities. Online platforms provide avenues for creating passive income, through investments or content creation, which can complement traditional employment. As more individuals explore their capabilities and the possibilities available, the allure of an extraordinary life becomes increasingly attainable.

In essence, embracing the idea of multiple income streams is about cultivating a mindset open to growth and opportunity. It is a proactive approach to life that encourages exploration beyond conventional employment models. By taking actionable steps toward establishing diverse income sources, individuals can significantly enhance their financial prospects and ultimately experience a richer, more extraordinary life. Making the conscious decision to diversify can empower individuals to live life to the fullest, ensuring they thrive amidst the complexities of today’s world.